Uninsured and Underinsured Motorist Coverage in Colorado: What the Statutes Actually Say

You carry auto insurance. You follow the rules. Then someone without insurance—or without enough insurance—crashes into you. Suddenly, you’re facing serious injuries and the person who caused them can’t pay.

This is exactly why uninsured motorist (UM) and underinsured motorist (UIM) coverage exists. These often-overlooked parts of your own auto policy can be the difference between full compensation and financial devastation.

This guide explains what Colorado law requires, how UM and UIM coverage actually works, and what you need to know to use it effectively.

The Legal Foundation: CRS 10-4-609 and 10-4-610

Colorado’s uninsured motorist laws are found primarily in CRS 10-4-609 and CRS 10-4-610. Here’s what these statutes establish:

Mandatory Offer Requirement: Colorado insurers must offer UM and UIM coverage to every policyholder. You can’t buy an auto policy in Colorado without being presented with the option.

Right to Reject: You can decline UM/UIM coverage in writing. Many people do this to lower their premiums—often without understanding what they’re giving up.

Coverage for Family Members: UM/UIM coverage typically extends to the named insured, family members residing in the household, and anyone occupying the covered vehicle with permission.

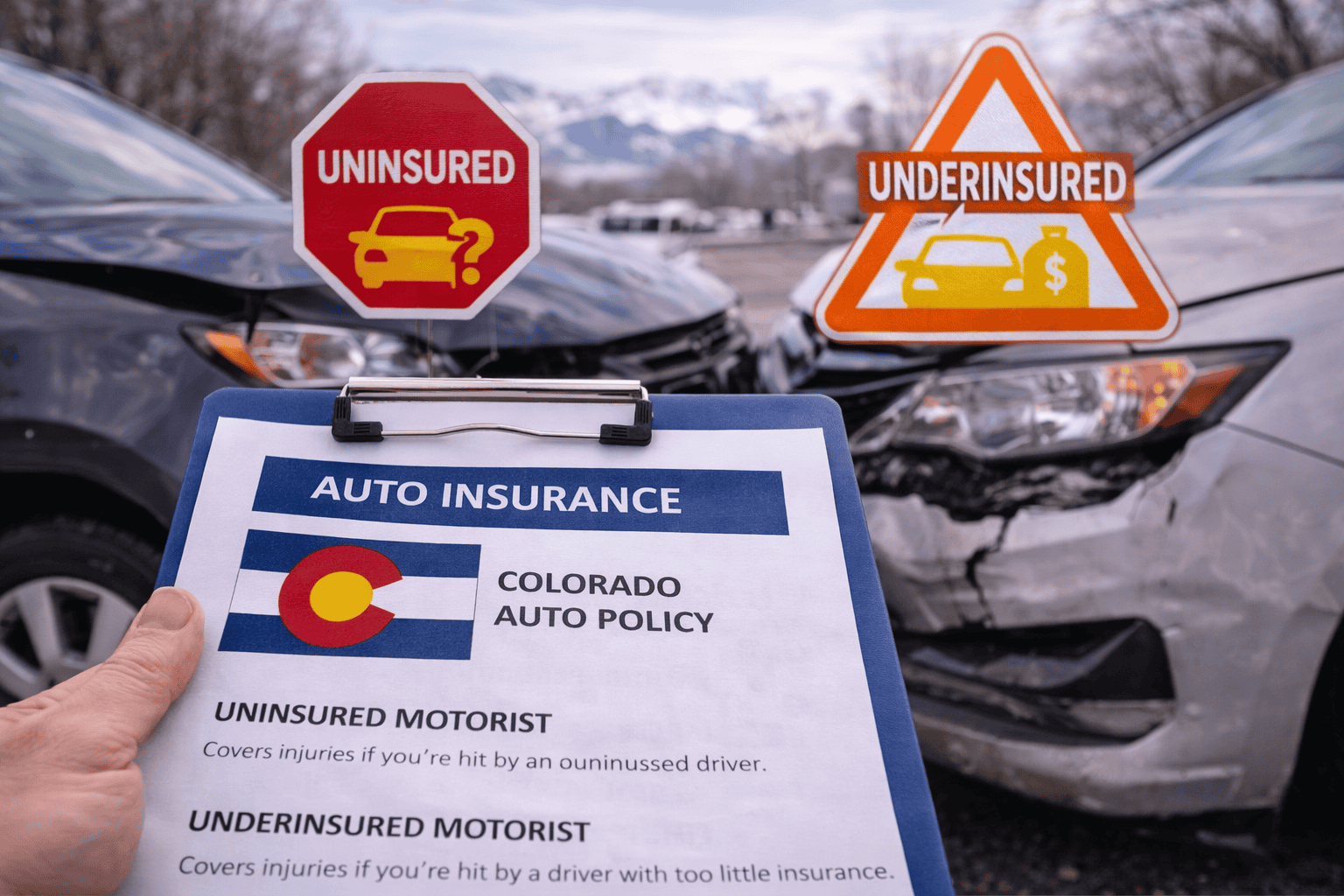

UM vs. UIM: Understanding the Difference

Though often purchased together, uninsured and underinsured motorist coverage serve distinct purposes:

| Uninsured Motorist (UM) | Underinsured Motorist (UIM) |

| At-fault driver has NO liability insurance | At-fault driver has INSUFFICIENT insurance |

| Covers hit-and-run accidents | Does NOT cover hit-and-runs |

| Your policy acts as if you’re suing the uninsured driver | Fills gap between their coverage and your damages |

When UM Coverage Applies

UM coverage kicks in when the at-fault driver:

– Has no liability insurance at all

– Has a policy that was cancelled or lapsed

– Flees the scene and is never identified (hit-and-run)

– Has an insurer that becomes insolvent

When UIM Coverage Applies

UIM coverage applies when the at-fault driver’s insurance exists but isn’t enough. For example:

You have $100,000 in damages. The at-fault driver carries only the $25,000 state minimum. Their insurance pays $25,000. Your UIM coverage can pay up to its limit (minus the $25,000 already received) to help cover the $75,000 gap.

How Coverage Limits Work

UM/UIM limits are usually expressed the same way as liability limits (e.g., 100/300 means $100,000 per person, $300,000 per accident). Your coverage can be equal to or less than your liability limits, but typically not more.

Stacking: When Multiple Policies Apply

Colorado permits “stacking” of UM/UIM coverage in certain situations. If you have multiple vehicles on your policy, or multiple policies in your household, you may be able to combine (stack) the coverage limits.

For example, if you have two cars on your policy with $100,000 UM coverage each, stacking could provide $200,000 in total UM protection. However, many policies contain anti-stacking provisions. Whether stacking applies depends on your specific policy language and the circumstances of your claim.

Filing a UM/UIM Claim: The Process

Step 1: Exhaust the At-Fault Driver’s Coverage (UIM Only)

For UIM claims, you typically must first obtain the full available coverage from the at-fault driver’s insurer before your UIM coverage applies. This doesn’t mean you have to accept an inadequate settlement—but the other insurance needs to pay its limits.

Critical: Before accepting any settlement from the at-fault driver’s insurer, notify your own insurance company. Many policies require you to get their consent before settling with the third party. Settling without consent can jeopardize your UIM claim.

Step 2: Notify Your Insurance Company

Report the claim to your own insurer promptly. Your policy has notice requirements—failing to provide timely notice can give them grounds to deny coverage.

Step 3: Prove Your Damages

You’ll need to document your injuries and damages just as you would in any injury claim. Medical records, bills, wage loss documentation, and evidence of pain and suffering all support your claim.

Step 4: Negotiate or Arbitrate

Many UM/UIM disputes are resolved through arbitration rather than litigation. Your policy may contain a mandatory arbitration clause. Arbitration can be faster than court, but it has its own procedures and pitfalls.

Common Issues in UM/UIM Claims

“Physical Contact” Requirements for Hit-and-Runs

Some policies require actual physical contact with the unidentified vehicle for UM coverage to apply in hit-and-run situations. If a phantom vehicle runs you off the road without touching your car, coverage might be denied under these policies.

Colorado courts have interpreted these clauses, and whether they apply depends on your specific policy language and the circumstances of your accident.

Disputes Over “Legally Entitled to Recover”

UM/UIM policies typically require that you be “legally entitled to recover” damages from the uninsured/underinsured motorist. This means you must prove the other driver’s fault and your damages—even though you’re making a claim on your own policy.

Your insurance company essentially steps into the shoes of the at-fault driver’s insurer. They can raise any defense that driver could have raised—including comparative negligence.

Offsets and Reductions

UIM coverage typically offsets amounts you’ve already received from the at-fault driver’s insurance. If your UIM limit is $100,000 and you received $25,000 from the other driver, your maximum UIM recovery is usually $75,000 (not an additional $100,000).

Why UM/UIM Coverage Matters: A Reality Check

Consider these facts:

– A significant percentage of Colorado drivers are uninsured despite legal requirements

– Many insured drivers carry only the minimum 25/50/15 coverage

– A single day in the hospital can exceed $10,000

– Serious injuries easily generate six-figure medical bills

Without adequate UM/UIM coverage, you’re betting that the person who hits you will have enough insurance to cover your damages. That’s a bet many accident victims lose.

Getting Help with Your UM/UIM Claim

UM and UIM claims involve nuances that don’t exist in typical third-party claims. You’re dealing with your own insurance company—a company you’ve been paying premiums to—but they’re not necessarily on your side. They have financial incentives to minimize your payout.

An attorney can help you understand your policy, avoid procedural missteps that could jeopardize coverage, and maximize your recovery.

If you’ve been injured by an uninsured or underinsured driver, call Flanagan Law at 720-928-9178 for a free consultation. We’ll review your coverage and help you understand all available options for recovery.

Frequently Asked Questions

Will making a UM/UIM claim raise my rates?

Colorado law prohibits insurers from raising rates solely because you filed a not-at-fault claim. However, some insurers find ways to increase rates, and practices vary. If you believe your rates were unfairly raised, you can file a complaint with the Division of Insurance.

Can I sue the uninsured driver AND make a UM claim?

You can pursue both, but you can’t collect twice for the same damages. If you recover from the uninsured driver (unlikely if they truly have no assets), your UM recovery would be offset. In practice, people with no insurance usually have no collectible assets either.

What if my UM/UIM coverage is lower than my damages?

You can only recover up to your policy limits. This is why carrying higher UM/UIM limits—even though it costs more—can be a wise investment. You’re protecting yourself against exactly this scenario.

Does UM/UIM cover property damage?

UM/UIM coverage primarily addresses bodily injury. Property damage from uninsured motorists is typically covered under your collision coverage (if you have it) or uninsured motorist property damage coverage (UMPD), which is a separate optional coverage in Colorado.

Sources

Colorado Revised Statutes § 10-4-609 (Uninsured Motorist Coverage Requirements)

Colorado Revised Statutes § 10-4-610 (Underinsured Motorist Coverage)

Colorado Division of Insurance—Consumer Guides