When Your Employer’s Vehicle Causes Your Injuries: Workers’ Comp vs. Personal Injury in Colorado

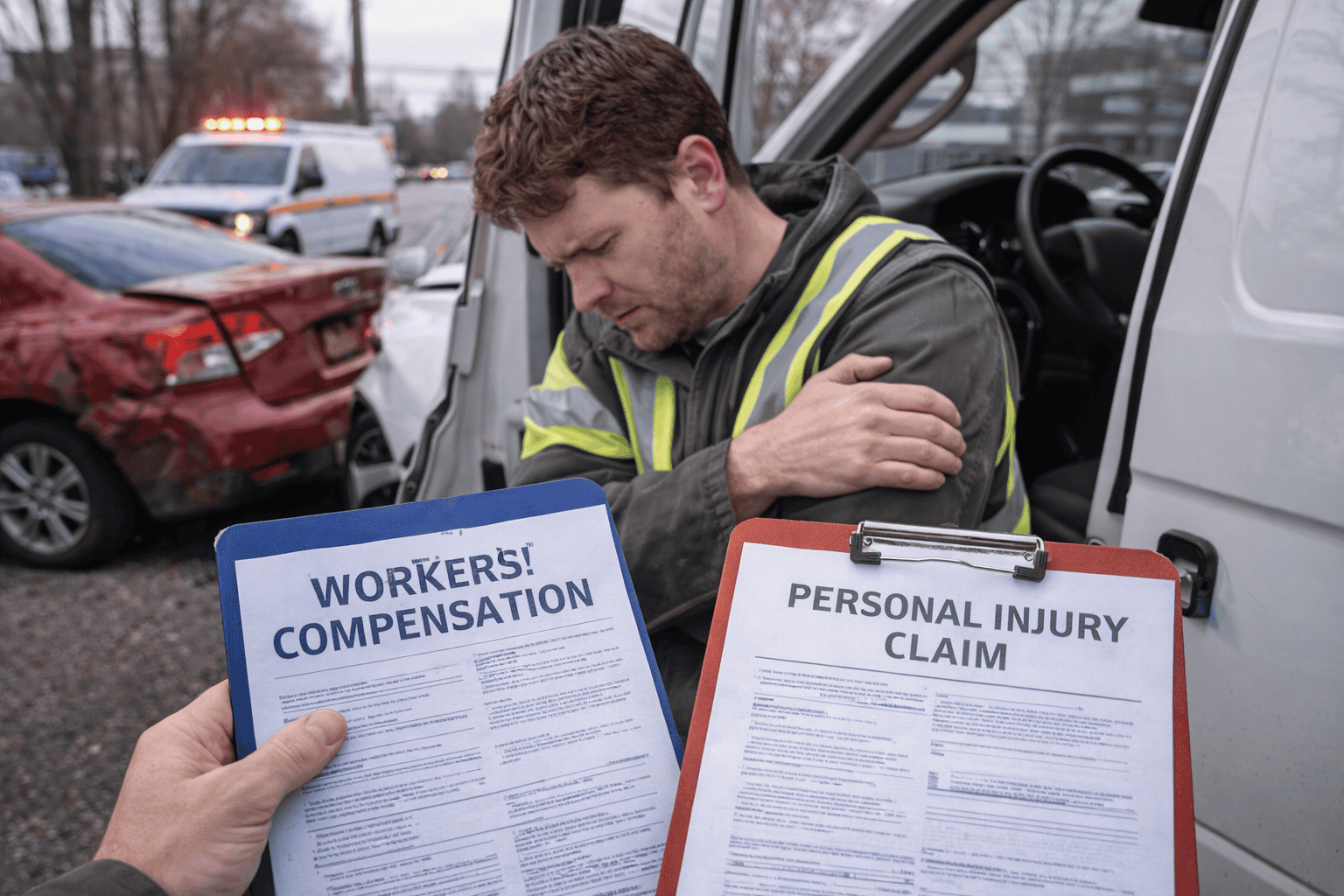

You were rear-ended while making deliveries in a company van. Or maybe you were a passenger when your coworker ran a red light in the work truck. Either way, you’re hurt, you’re confused about your options, and you’re getting conflicting advice about whether this is a workers’ comp issue or something else entirely.

The answer—like most things involving workplace injuries and car accidents—is that it depends. And sometimes, it’s both.

The Workers’ Compensation Framework

In Colorado, workers’ compensation is a no-fault system. If you’re injured in the course of your employment, you’re generally entitled to benefits regardless of who caused the accident. You don’t have to prove your employer was negligent. You don’t have to prove the other driver was at fault. You just have to show the injury happened while you were doing your job.

This sounds straightforward, but vehicle accidents complicate things.

What Workers’ Comp Covers

Workers’ compensation provides medical treatment for your injuries, temporary disability benefits if you can’t work (typically two-thirds of your average weekly wage, up to a statutory maximum), permanent disability benefits if you don’t fully recover, and vocational rehabilitation if you can’t return to your previous job.

What workers’ comp doesn’t cover: pain and suffering, full lost wages, or punitive damages. The trade-off for guaranteed benefits is limited compensation.

The Exclusive Remedy Rule

Colorado’s workers’ compensation system operates under what’s called the “exclusive remedy” doctrine. In most cases, if you’re injured on the job, workers’ comp is your only recourse against your employer—even if your employer’s negligence contributed to your accident.

Your employer can’t be sued for providing a poorly maintained vehicle. They can’t be sued for pressuring you to drive in dangerous conditions. Workers’ comp is the exclusive remedy.

But there’s a significant exception that opens doors for accident victims.

When a Third Party Changes Everything

The exclusive remedy rule only applies to claims against your employer. It doesn’t protect third parties whose negligence caused your injuries.

If another driver—someone not employed by your company—caused the accident that injured you, you can pursue a personal injury claim against them while also receiving workers’ compensation benefits. This is called a “third-party claim,” and it can dramaticaly increase your total recovery.

The Advantages of a Third-Party Claim

A personal injury claim against the at-fault driver can compensate you for pain and suffering (not available through workers’ comp), the full amount of your lost wages (not just two-thirds), loss of enjoyment of life, future earning capacity, and other damages that workers’ comp simply doesn’t cover.

In serious accidents, the difference between workers’ comp alone and workers’ comp plus a third-party settlement can be tens or even hundreds of thousands of dollars.

How the Two Claims Interact

You can pursue both claims simultaneously, but they’re connected in important ways. Your employer’s workers’ comp insurance company has a right to be repaid from any third-party settlement. This is called subrogation.

If workers’ comp pays $50,000 for your medical bills and lost wages, and you later settle with the at-fault driver for $150,000, the workers’ comp carrier will want their $50,000 back from your settlement. How this repayment is calculated—and whether it can be reduced—significantly impacts what you actually receive.

Scenarios That Complicate the Picture

Not every work-related vehicle accident fits neatly into these categories. Some situations create genuine complexity.

Your Coworker Caused the Accident

If a coworker was driving the company vehicle and their negligence caused your injuries, you generally can’t sue them directly—they’re protected by the workers’ comp exclusive remedy rule as agents of your employer. Your recovery is limited to workers’ comp benefits, even if your coworker was texting while driving or ran a stop sign.

There’s an exception for intentional acts. If your coworker deliberately caused the accident, the exclusive remedy protection may not apply. But negligence, even gross negligence, typically isn’t enough.

The Vehicle Was Defective

If a defective vehicle or vehicle component contributed to your injuries, you may have a product liability claim against the manufacturer. This is another third-party claim that can supplement your workers’ comp benefits. Defective brakes, faulty steering systems, tire blowouts, and airbag failures have all formed the basis of successful product liability claims.

You Were an Independent Contractor

Independent contractors aren’t covered by workers’ compensation in most cases. If you were working as a contractor when another driver injured you, your only recourse is a personal injury claim against the at-fault driver. You won’t have workers’ comp benefits to fall back on, but you also won’t have a subrogation claim reducing your settlement.

The line between employee and independent contractor isn’t always clear, and misclassification is common. If you’re unsure of your status, it’s worth investigating.

Navigating Both Systems at Once

Handling a workers’ comp claim and a personal injury claim simultaneously requires careful coordination. Deadlines are different. Documentation requirements are different. What you say to one adjuster can affect the other claim.

Workers’ comp claims must be filed within two years of the injury, but you should report workplace injuries to your employer immediately. Personal injury claims against third parties have a three-year statute of limitations in Colorado. Settlement negotiations in one case can impact the other.

Insurance adjusters on both sides have their own interests, and those interests don’t align with yours. The workers’ comp carrier wants to minimize benefits paid and maximize their subrogation recovery. The at-fault driver’s insurance wants to pay as little as possible for your injuries.

Protecting Your Full Recovery

If you’ve been injured in a work-related vehicle accident, don’t assume workers’ comp is your only option. Don’t sign anything or accept settlements without understanding how both claims interact. Don’t give recorded statements without knowing how they might be used.

Call Flanagan Law at 720-928-9178 for a free consultation. We’ll evaluate your situation, identify all potential sources of recovery, and help you navigate both the workers’ compensation system and any third-party claims you may have.

Frequently Asked Questions

Can my employer fire me for filing a workers’ comp claim?

Colorado law prohibits employers from retaliating against employees for filing workers’ compensation claims. If you’re terminated, demoted, or otherwise penalized for pursuing your rightful benefits, you may have a separate retaliation claim.

What if I was partially at fault for the accident?

For workers’ comp, fault doesn’t matter—you’re covered regardless. For a third-party claim, Colorado’s comparative negligence rule applies. Your recovery is reduced by your percentage of fault, and if you’re more than 50% responsible, you can’t recover anything from the other party.

How long do I have to report a work-related accident to my employer?

You should report workplace injuries immediately, but Colorado law requires written notice within four days of the accident if possible. Failing to report promptly can jeopardize your workers’ comp claim.

Do I need separate attorneys for workers’ comp and personal injury claims?

Not necessarily. Many personal injury attorneys also handle workers’ compensation cases, which allows for coordinated strategy across both claims. This can be important when negotiating subrogation and ensuring maximum total recovery.